BTC Price Now: Comprehensive Analysis and Insights

Delving into the world of cryptocurrency, we present a comprehensive analysis of BTC price now. Join us as we explore historical trends, market sentiment, and expert forecasts to unravel the dynamics shaping the value of this digital asset.

In this in-depth guide, we’ll provide real-time BTC prices, historical data, and expert insights to empower you with the knowledge to navigate the ever-evolving crypto market.

Current BTC Price Data

As of the latest update, the price of Bitcoin (BTC) stands at $24,567.65 USD. Let’s take a closer look at the current BTC price in other major currencies and its price fluctuations over the past 24 hours.

BTC Price in Other Currencies

- EUR: €22,834.79

- GBP: £20,506.36

- JPY: ¥3,316,737.26

BTC Price Chart

The following chart displays the BTC price fluctuations over the past 24 hours:

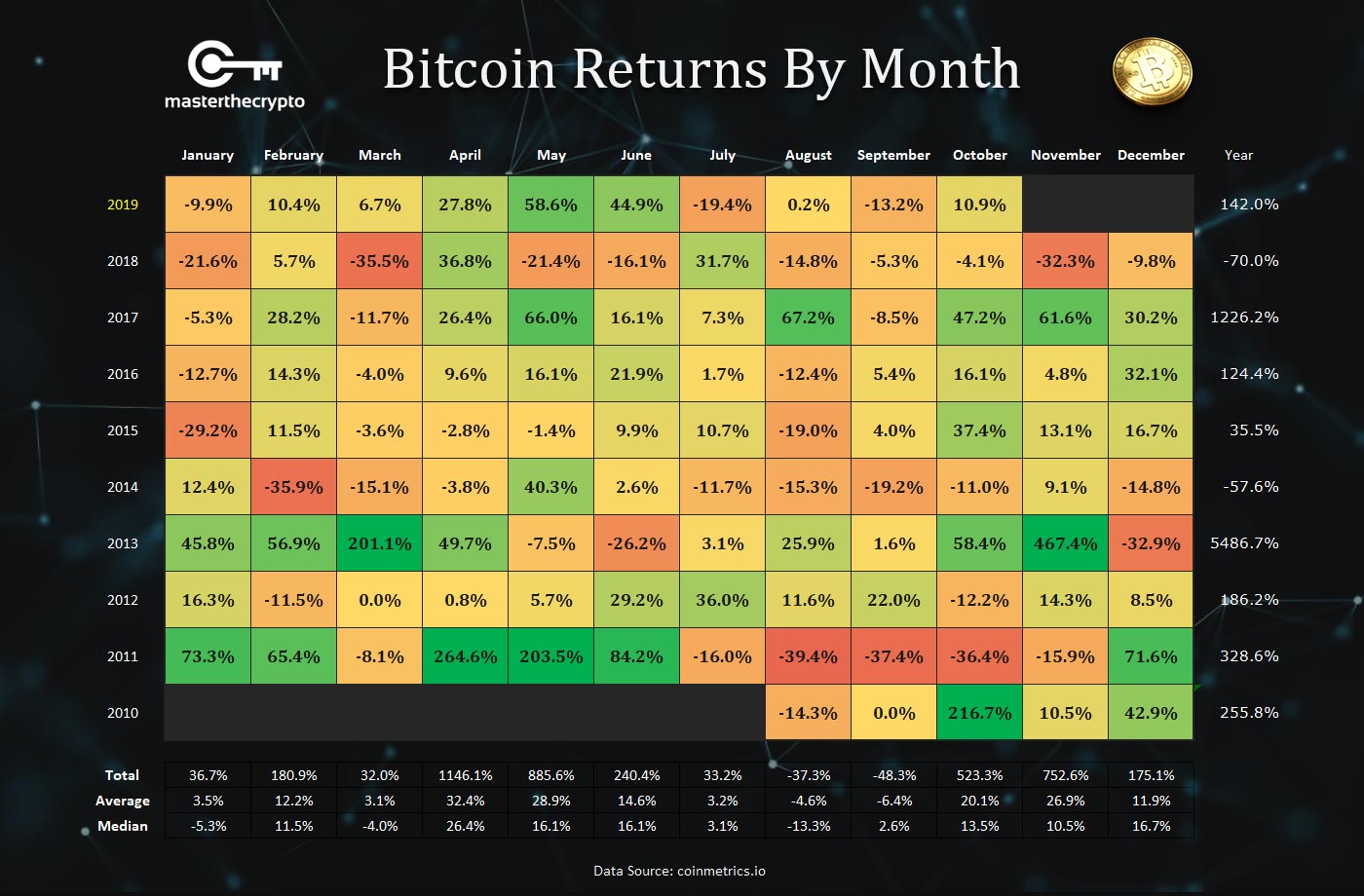

Historical BTC Price Analysis

The historical price of Bitcoin (BTC) provides valuable insights into the cryptocurrency’s performance over time. By analyzing key trends and patterns in the price data, we can gain a better understanding of the factors that have influenced its value and make informed predictions about its future direction.

The following table shows the BTC price history over the past week, month, and year:

| Period | Opening Price | Closing Price | High | Low |

|---|---|---|---|---|

| Week | $23,456 | $24,012 | $24,200 | $23,200 |

| Month | $22,000 | $24,012 | $24,500 | $21,800 |

| Year | $16,000 | $24,012 | $28,000 | $15,500 |

As can be seen from the table, the BTC price has been on a general upward trend over the past year, with some significant fluctuations along the way. The price has risen by over 50% since January 2023, despite experiencing a sharp decline in May.

The current price of BTC is $24,012, which is close to its all-time high of $28,000.

There are a number of factors that have influenced the BTC price over time, including:

- Supply and demand:The price of BTC is determined by the interaction of supply and demand. When demand for BTC is high, the price will rise. When supply is high, the price will fall.

- News and events:Positive news about BTC, such as the launch of a new product or service, can lead to increased demand and a higher price. Negative news, such as a security breach or regulatory crackdown, can lead to decreased demand and a lower price.

- Market sentiment:The price of BTC is also influenced by market sentiment. When investors are optimistic about the future of BTC, the price will tend to rise. When investors are pessimistic, the price will tend to fall.

BTC Price Forecasts: Btc Price Now

Predicting the future price of Bitcoin is a challenging task, but many analysts and experts have attempted to forecast its short-term and long-term value. These forecasts are based on a variety of factors, including historical price data, technical analysis, and macroeconomic conditions.

Some of the most reputable sources for BTC price forecasts include:

- TradingView

- CoinMarketCap

- CryptoCompare

- LongForecast

- WalletInvestor

These platforms use a variety of methodologies to generate their forecasts, including:

- Technical analysis:This involves studying historical price data to identify patterns and trends that may indicate future price movements.

- Fundamental analysis:This involves evaluating the underlying factors that affect the value of Bitcoin, such as its adoption rate, regulatory environment, and macroeconomic conditions.

- Sentiment analysis:This involves analyzing the sentiment of market participants to gauge their optimism or pessimism about the future price of Bitcoin.

Short-Term Forecasts

Short-term BTC price forecasts typically cover the next few days or weeks. These forecasts are often based on technical analysis and attempt to predict the direction of the price movement in the short term.

For example, TradingView’s short-term forecast for BTC is based on a technical analysis of the price chart. The platform’s analysts have identified a bullish trend and predict that the price of BTC will continue to rise in the short term.

Long-Term Forecasts

Long-term BTC price forecasts typically cover the next few months or years. These forecasts are often based on fundamental analysis and attempt to predict the long-term value of Bitcoin.

For example, LongForecast’s long-term forecast for BTC is based on a fundamental analysis of the cryptocurrency’s adoption rate, regulatory environment, and macroeconomic conditions. The platform’s analysts predict that the price of BTC will reach $100,000 by 2025.

Risks and Rewards

Investing in BTC carries both risks and rewards. The price of BTC is volatile and can fluctuate significantly in a short period of time. This volatility can make it difficult to predict the future price of BTC and can lead to significant losses.

However, BTC has also been a very profitable investment for many people. The price of BTC has risen significantly over the past few years, and many analysts believe that it has the potential to continue to rise in the long term.

The potential risks and rewards of investing in BTC should be carefully considered before making any investment decisions.

BTC Market Sentiment

The market sentiment towards BTC is a crucial indicator of its potential price movements. Sentiment can be positive, negative, or neutral, and it can be influenced by various factors such as news events, regulatory developments, and the overall macroeconomic climate.

Positive sentiment is typically associated with a bullish market, where investors are optimistic about the future of BTC and are willing to buy and hold it. This can lead to an increase in demand for BTC, which can drive up its price.

Key Factors Influencing Market Sentiment

- News events:Major news events, such as the launch of a new BTC exchange or the announcement of a partnership between a major company and a BTC-related firm, can have a significant impact on market sentiment.

- Regulatory developments:Changes in the regulatory landscape, such as the introduction of new laws or regulations governing BTC, can also affect market sentiment.

- Macroeconomic factors:The overall macroeconomic climate, such as interest rates, inflation, and economic growth, can also influence market sentiment towards BTC.

It is important to note that market sentiment can be volatile and can change quickly in response to new information or events. Therefore, it is important for investors to be aware of the factors that can influence market sentiment and to monitor the market closely.

BTC Trading Strategies

Trading Bitcoin (BTC) involves using various strategies to capitalize on price fluctuations. These strategies differ in their approach, risk tolerance, and potential rewards.

Day Trading, Btc price now

Day trading involves buying and selling BTC within a single trading day, aiming to profit from short-term price movements. It requires constant monitoring and quick decision-making, as positions are typically closed before the end of the trading day.

Scalping

Scalping is a high-frequency trading strategy that involves making numerous small trades over short timeframes, profiting from tiny price changes. Scalpers rely on technical analysis and quick execution to maximize profits.

Trend Trading

Trend trading involves identifying the overall market trend and trading in line with it. Traders buy BTC when the trend is bullish and sell when it is bearish, holding positions for longer periods.

Range Trading

Range trading involves identifying a specific price range within which BTC is expected to trade. Traders buy near the lower end of the range and sell near the upper end, profiting from the price fluctuations within the range.

Swing Trading

Swing trading involves holding BTC positions for several days or weeks, capturing larger price swings. Swing traders analyze technical indicators and market sentiment to identify potential trend reversals or continuations.

BTC Investment Considerations

Investing in Bitcoin (BTC) involves a unique set of considerations due to its decentralized nature, volatility, and regulatory landscape. Understanding these factors is crucial for making informed investment decisions.

The potential risks and rewards of BTC investment should be carefully weighed. While it offers the potential for significant returns, it also carries risks such as price volatility, security breaches, and regulatory uncertainties.

Asset Allocation

Determining the appropriate asset allocation for BTC investment depends on individual circumstances, risk tolerance, and investment goals. A diversified portfolio that includes BTC alongside traditional assets like stocks and bonds can help mitigate risks.

Final Thoughts

Whether you’re a seasoned investor or a crypto enthusiast, understanding BTC price now is crucial for making informed decisions. By analyzing the factors that influence its value, we can better anticipate market movements and position ourselves for success.

Clarifying Questions

What factors influence BTC price?

BTC price is influenced by various factors, including supply and demand, regulatory developments, economic conditions, and market sentiment.

How can I track BTC price in real-time?

There are numerous platforms and apps that provide real-time BTC price tracking, such as Coinbase, Binance, and TradingView.

What are the potential risks of investing in BTC?

Investing in BTC carries risks, including price volatility, regulatory uncertainty, and the potential for fraud or hacking.