BTC Price Today: Comprehensive Analysis and Future Predictions

BTC price today stands as a testament to the ever-evolving landscape of the cryptocurrency market. This in-depth analysis delves into the historical milestones, current market dynamics, and potential future trajectories of Bitcoin, providing valuable insights for investors and enthusiasts alike.

Our comprehensive exploration encompasses technical and fundamental analysis, market sentiment, and expert predictions, offering a multifaceted perspective on the factors shaping BTC’s price movements.

BTC Price History

Bitcoin’s price history is a rollercoaster ride, marked by meteoric rises and dramatic falls. Understanding the factors that have shaped its trajectory is crucial for investors and enthusiasts alike.

In the early days, BTC’s value was primarily driven by speculation and limited adoption. However, as its popularity grew, so did its price, reaching its first major milestone in 2013 when it surpassed $1,000.

Market Demand and Supply, Btc price today

The interplay between market demand and supply has significantly influenced BTC’s price. Surges in demand, often driven by positive news or hype, have led to price spikes. Conversely, periods of low demand or negative sentiment have resulted in price declines.

Regulatory Changes

Government regulations and institutional involvement have also played a role in BTC’s price fluctuations. Positive regulatory developments, such as the launch of regulated exchanges, have boosted investor confidence and pushed prices higher. On the other hand, negative news, like regulatory crackdowns or bans, has often led to price drops.

Technological Advancements

Technological advancements, such as the development of faster and more secure blockchain networks, have also impacted BTC’s price. Upgrades and innovations have increased the coin’s usability and adoption, leading to increased demand and higher prices.

Timeline of Significant Events

- 2009:Bitcoin is created by Satoshi Nakamoto.

- 2011:BTC reaches parity with the US dollar.

- 2013:BTC surpasses $1,000 for the first time.

- 2017:BTC reaches its all-time high of nearly $20,000.

- 2018:BTC experiences a prolonged bear market, dropping to below $3,000.

- 2020:BTC rallies to new highs, surpassing $40,000.

Current BTC Market Analysis

Bitcoin’s price has been experiencing a volatile week, with significant fluctuations and mixed market sentiment. As of [current date], the price of BTC stands at [current price], with a market capitalization of [market cap]. The 24-hour trading volume is [trading volume], indicating a relatively high level of market activity.

Market sentiment towards BTC remains divided, with some analysts expressing optimism about a potential bull run, while others remain cautious about the short-term outlook. Bullish indicators include the recent surge in institutional adoption of BTC, the increasing number of active BTC addresses, and the overall positive macroeconomic environment.

Impact of Current Events and News

Recent events and news have had a noticeable impact on BTC’s price. The ongoing geopolitical tensions between Russia and Ukraine have created uncertainty in the financial markets, leading to increased demand for safe-haven assets like BTC. Additionally, the upcoming Federal Reserve meeting and potential interest rate hike have also influenced market sentiment, as investors anticipate the impact of monetary policy on risk assets like BTC.

Technical Analysis

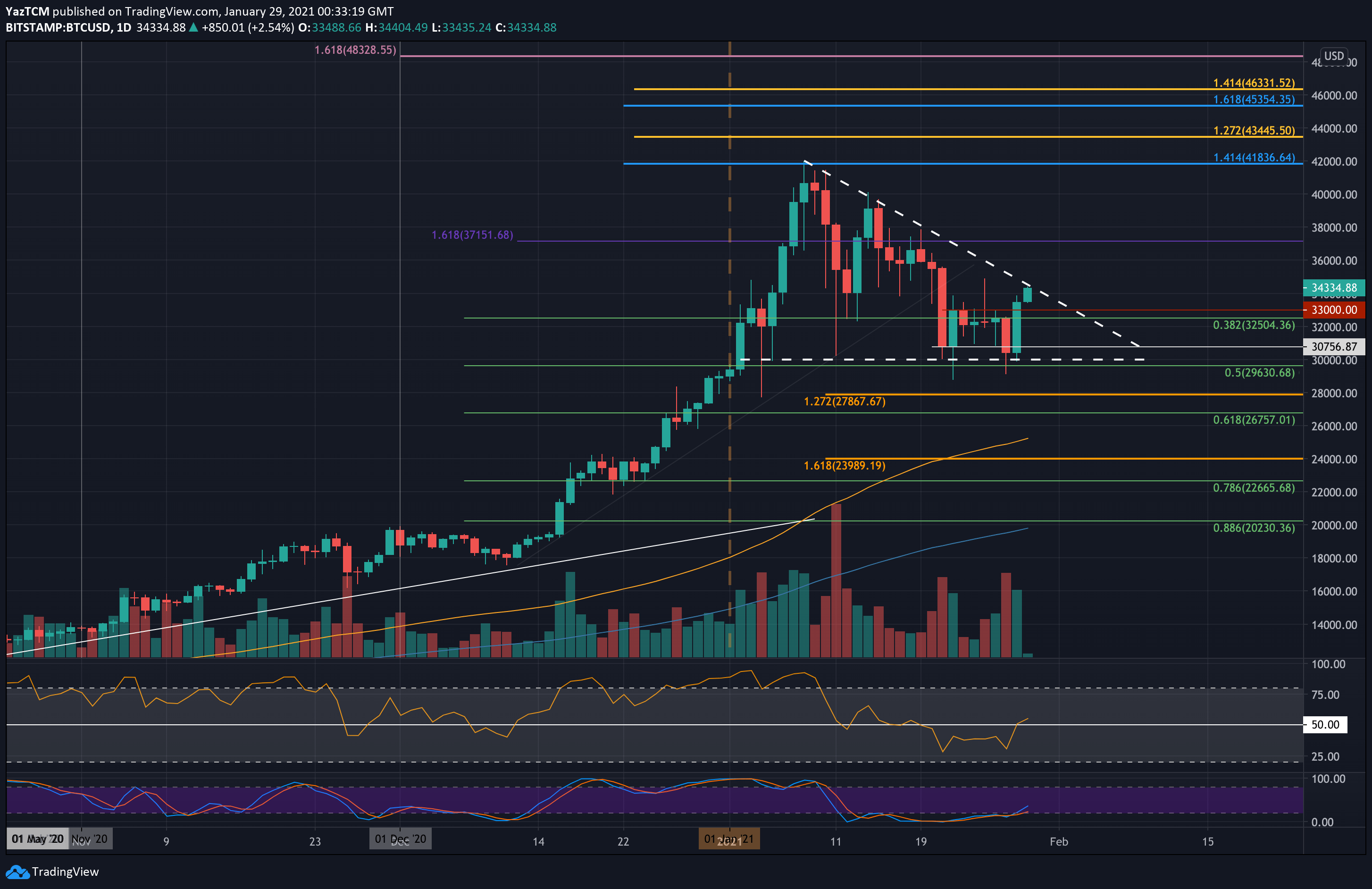

Technical analysis is a method of evaluating the past performance of an asset to predict its future price movements. It involves studying price charts, volume data, and other indicators to identify patterns and trends that can help traders make informed decisions.

When conducting technical analysis on BTC, there are several key factors to consider:

Support and Resistance Levels

Support and resistance levels are price points at which the price of an asset has difficulty moving past. Support levels are areas where the price tends to bounce back up, while resistance levels are areas where the price tends to be rejected.

Identifying these levels can help traders determine potential areas for buying and selling.

Moving Averages

Moving averages are a technical indicator that shows the average price of an asset over a specified period of time. They can help traders identify trends and determine whether the price is in an uptrend or a downtrend.

Bollinger Bands

Bollinger Bands are a technical indicator that shows the volatility of an asset. They are composed of three lines: an upper band, a lower band, and a middle band. The upper and lower bands are two standard deviations above and below the middle band, respectively.

When the price is above the upper band, it is considered to be overbought. When the price is below the lower band, it is considered to be oversold.

Fibonacci Retracements

Fibonacci retracements are a technical indicator that shows the potential areas where an asset may retrace after a significant move. They are based on the Fibonacci sequence, which is a series of numbers in which each number is the sum of the two preceding numbers.

The most common Fibonacci retracement levels are 23.6%, 38.2%, 50%, 61.8%, and 78.6%.

Visual Representations

Visual representations of technical analysis findings can help traders visualize the patterns and trends that they have identified. These representations can include charts, graphs, and other visual aids.

Fundamental Analysis

Fundamental analysis assesses the intrinsic value of BTC by examining its underlying blockchain technology, adoption rate, and regulatory landscape. It evaluates the long-term growth potential and role of BTC in the cryptocurrency market, comparing its fundamentals to other cryptocurrencies and traditional investments.

Blockchain Technology

- BTC’s decentralized and secure blockchain provides transparency, immutability, and trustless transactions.

- The underlying technology supports smart contracts, enabling the creation of decentralized applications and complex financial instruments.

Adoption Rate

BTC’s widespread adoption by individuals, institutions, and businesses indicates its increasing acceptance and recognition as a legitimate asset class.

Regulatory Landscape

Regulatory developments impact BTC’s value and adoption. Clear and supportive regulations can foster growth, while uncertainty or negative regulations can hinder it.

Market Predictions

Predicting the future direction of BTC’s price is a complex endeavor, influenced by a myriad of factors. Nonetheless, based on technical and fundamental analysis, informed predictions can be made.

Technological advancements, such as the development of more efficient mining algorithms and the adoption of BTC by institutional investors, could provide tailwinds for BTC’s growth. Additionally, regulatory changes that clarify the legal status of BTC and provide a framework for its use could enhance its credibility and appeal to a broader range of investors.

Economic Conditions

The broader economic conditions also play a significant role in shaping BTC’s price. During periods of economic uncertainty or market volatility, BTC has often been viewed as a safe haven asset, leading to increased demand and price appreciation.

Different Scenarios

Different scenarios can be envisioned for BTC’s future price trajectory:

- Bullish Scenario:Continued technological advancements, regulatory clarity, and favorable economic conditions could propel BTC’s price to new highs.

- Bearish Scenario:Negative regulatory developments, technological setbacks, or a prolonged economic downturn could lead to a decline in BTC’s price.

- Sideways Scenario:BTC’s price could consolidate within a range, as competing factors balance each other out.

Investors should carefully consider these scenarios and their implications when making investment decisions related to BTC.

Final Summary: Btc Price Today

As the cryptocurrency market continues to evolve, BTC price today remains a key indicator of its overall health and trajectory. By understanding the underlying factors influencing its value, investors can make informed decisions and navigate the complexities of this dynamic market.

Frequently Asked Questions

What factors influence BTC price today?

BTC price today is influenced by a combination of factors, including market demand and supply, regulatory changes, technological advancements, and economic conditions.

How can I predict future BTC price movements?

Predicting future BTC price movements requires a combination of technical and fundamental analysis, considering historical patterns, market sentiment, and potential catalysts for growth or decline.

Is BTC a good investment?

The suitability of BTC as an investment depends on individual risk tolerance and investment goals. It is important to conduct thorough research and consider the potential risks and rewards before making an investment decision.