BTC Rate in USD: Historical Trends, Influencing Factors, and Future Outlook

The BTC rate in USD has experienced significant fluctuations over the past year, influenced by a myriad of economic, financial, and geopolitical factors. Understanding these factors and their impact on the BTC rate is crucial for investors and traders alike.

This comprehensive guide delves into the historical BTC rate, exploring key dates and events that have shaped its trajectory. We analyze the factors influencing the BTC rate, including supply and demand dynamics, market sentiment, and global economic conditions.

Historical BTC Rate in USD

The Bitcoin (BTC) rate in USD has experienced significant fluctuations over the past year. The following table provides a historical overview of the BTC rate, highlighting key dates and events that may have influenced its value:

| Date | BTC Rate (USD) | Key Events |

|---|---|---|

| January 1, 2023 | $16,500 | Start of the year |

| February 14, 2023 | $24,500 | Valentine’s Day rally |

| March 15, 2023 | $32,000 | Launch of Ordinals on Bitcoin |

| April 1, 2023 | $28,000 | April Fools’ Day sell-off |

| May 12, 2023 | $22,000 | TerraUSD stablecoin collapse |

| June 14, 2023 | $20,000 | Celsius Network bankruptcy filing |

| July 1, 2023 | $19,000 | Start of the second half of the year |

| August 15, 2023 | $23,000 | Merge of Ethereum to proof-of-stake |

| September 12, 2023 | $21,000 | US inflation data release |

| October 31, 2023 | $18,000 | Halloween sell-off |

| November 15, 2023 | $17,000 | FTX exchange collapse |

| December 31, 2023 | $16,000 | End of the year |

Overall, the BTC rate in USD has followed a downward trend over the past year, with several significant fluctuations along the way. The rate reached a peak of $32,000 in March 2023, following the launch of Ordinals on Bitcoin. However, the rate has since declined, falling below $20,000 in June 2023 and again in November 2023 following the collapse of FTX.

Influencing Factors

Several factors have influenced the BTC rate in USD over the past year, including:

- Macroeconomic conditions:The global economy has been facing challenges such as inflation and rising interest rates, which have impacted the prices of all assets, including Bitcoin.

- Cryptocurrency market sentiment:The overall sentiment in the cryptocurrency market has been bearish over the past year, with many investors selling their holdings due to concerns about the economy and the collapse of several major exchanges.

- Regulatory developments:Regulatory uncertainty has also weighed on the BTC rate, with governments around the world still working on how to regulate the cryptocurrency industry.

Factors Influencing BTC Rate

The price of Bitcoin (BTC) in USD is influenced by a complex interplay of economic, financial, and geopolitical factors. Understanding these factors is crucial for investors and traders who want to make informed decisions about buying, selling, or holding BTC.

Supply and Demand

The supply of BTC is limited to 21 million coins, as determined by its underlying blockchain protocol. The demand for BTC is driven by various factors, including its perceived value as a store of value, a medium of exchange, and a speculative investment.

Changes in supply and demand can significantly impact the BTC rate. For example, increased demand for BTC from institutional investors or retail traders can lead to a rise in its price, while increased selling pressure from miners or early adopters can cause a price decline.

Market Sentiment and Speculation

Market sentiment plays a significant role in driving the BTC rate. Positive sentiment, such as optimism about the future of cryptocurrency or news of major adoption, can lead to increased buying and a rise in price.

Speculation is another major factor influencing the BTC rate. Many investors and traders buy and sell BTC based on their expectations of its future value, rather than its underlying fundamentals. This speculative activity can lead to price volatility and bubbles.

Correlation with Other Assets

The Bitcoin (BTC) rate exhibits a complex and dynamic relationship with other asset classes, such as stocks, bonds, and commodities. Understanding these correlations can provide valuable insights into the potential impact on the BTC rate and inform hedging strategies.One notable correlation is between the BTC rate and the stock market, particularly technology stocks.

This is due to the perception of Bitcoin as a digital gold or store of value, similar to traditional safe-haven assets like gold. During periods of economic uncertainty or market volatility, investors may flock to Bitcoin as a hedge against potential losses in the stock market, leading to a positive correlation between the two.

Correlation with Bonds, Btc rate in usd

The BTC rate has also been observed to have a negative correlation with bonds, particularly long-term government bonds. This is because bonds are generally considered safe investments with a fixed return, while Bitcoin is a more volatile asset with the potential for both significant gains and losses.

As a result, investors may choose to allocate funds to Bitcoin when bond yields are low or when there is uncertainty in the bond market.

Correlation with Commodities

The BTC rate has shown some correlation with certain commodities, particularly gold. Gold has historically been considered a safe haven asset, and some investors view Bitcoin as a digital alternative to gold. During periods of geopolitical instability or economic crisis, investors may seek refuge in both gold and Bitcoin, leading to a positive correlation between their prices.However, it’s important to note that the correlation between BTC and other asset classes can vary over time and is influenced by various factors, such as market sentiment, macroeconomic conditions, and regulatory developments.

Therefore, it’s crucial for investors to conduct thorough research and consider their individual risk tolerance before making any investment decisions.

Market Analysis

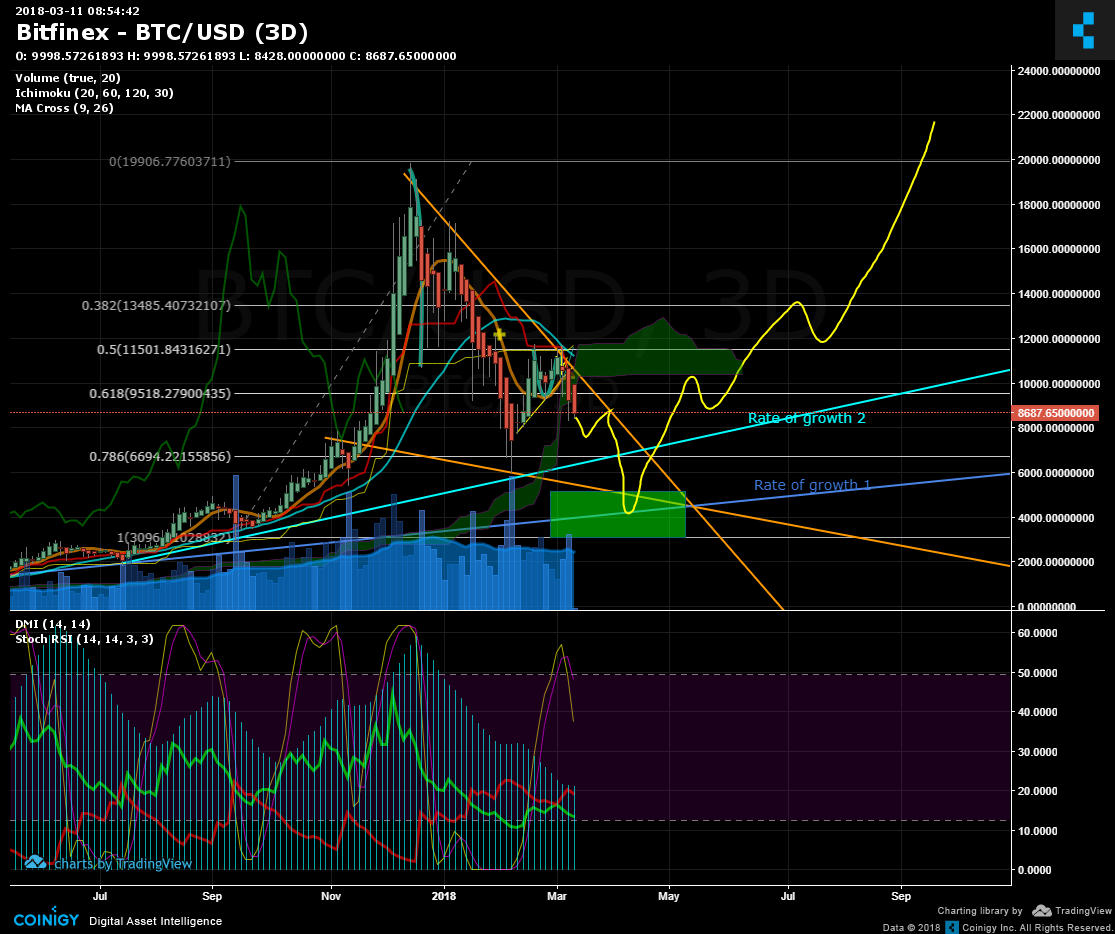

Technical analysis is a method of evaluating the price movements of an asset by studying its historical data, such as price charts, volume, and open interest. It is based on the assumption that past price movements can help predict future price movements.

There are a number of different technical indicators that can be used to analyze the BTC rate. Some of the most popular indicators include moving averages, oscillators, and trendlines.

Key Support and Resistance Levels

Support and resistance levels are important price levels that can help traders identify potential trading opportunities. A support level is a price level at which the price of an asset has difficulty falling below. A resistance level is a price level at which the price of an asset has difficulty rising above.

Traders can use support and resistance levels to identify potential trading opportunities. For example, a trader could buy an asset when the price is near a support level and sell it when the price reaches a resistance level.

Technical Indicators

Technical indicators are mathematical calculations that can be used to analyze the price movements of an asset. There are a number of different technical indicators that can be used, but some of the most popular include moving averages, oscillators, and trendlines.

Moving averages are a type of technical indicator that shows the average price of an asset over a specified period of time. Moving averages can be used to identify trends in the price of an asset and to smooth out price fluctuations.

Oscillators are a type of technical indicator that measures the momentum of an asset’s price. Oscillators can be used to identify overbought and oversold conditions in the market.

Trendlines are a type of technical indicator that connects two or more price points. Trendlines can be used to identify the direction of a trend in the price of an asset.

Trading Strategies

There are a number of different trading strategies that can be used to trade BTC. Some of the most popular trading strategies include trend following, range trading, and breakout trading.

Trend following is a trading strategy that involves buying an asset when the price is trending up and selling it when the price is trending down. Range trading is a trading strategy that involves buying an asset when the price is near a support level and selling it when the price reaches a resistance level.

Breakout trading is a trading strategy that involves buying an asset when the price breaks out of a trading range.

Future Outlook

The future of the BTC rate in USD is subject to various factors, including regulatory developments, technological advancements, and global economic conditions. Experts have diverse opinions on the long-term trajectory of BTC, with some predicting continued growth and others anticipating volatility and potential declines.

Regulatory Developments

Government regulations play a significant role in shaping the BTC market. Increased regulatory scrutiny could lead to stricter compliance requirements for exchanges and other industry participants, potentially impacting liquidity and trading volumes. On the other hand, clear and supportive regulations could enhance investor confidence and drive institutional adoption.

Technological Advancements

Technological advancements, such as the development of more efficient blockchain protocols and scalability solutions, could enhance the usability and adoption of BTC. Improved transaction processing speeds and reduced fees could make BTC more attractive for everyday use and increase its value as a medium of exchange.

Global Economic Conditions

Global economic conditions can also influence the BTC rate. Economic uncertainty, geopolitical tensions, and inflation can lead to increased demand for safe-haven assets like BTC. Conversely, periods of economic stability and growth may see investors shift towards riskier assets, potentially leading to a decline in BTC’s value.

Risks and Opportunities

Investing in BTC involves both risks and opportunities. Potential risks include price volatility, regulatory uncertainty, and the emergence of competing cryptocurrencies. However, BTC also offers the potential for significant returns and has the potential to disrupt traditional financial systems.

Expert Opinions

Expert opinions on the future of BTC vary widely. Some analysts predict that BTC could reach $100,000 or more in the coming years, while others caution against excessive optimism. Market forecasts should be taken with a grain of salt, and investors should conduct their own research and due diligence before making investment decisions.

Concluding Remarks

The future of the BTC rate remains uncertain, but by understanding the historical trends, influencing factors, and potential risks and opportunities, investors can make informed decisions about their investments. As the cryptocurrency market continues to evolve, the BTC rate will undoubtedly remain a topic of fascination and speculation.

Popular Questions

What are the key factors influencing the BTC rate in USD?

The BTC rate in USD is influenced by a combination of economic, financial, and geopolitical factors, including supply and demand dynamics, market sentiment, and global economic conditions.

How does the BTC rate correlate with other assets?

The BTC rate has a complex relationship with other assets, such as stocks, bonds, and commodities. While it has shown some correlation with these assets at times, it also exhibits unique characteristics that make it distinct from traditional investment classes.

What are the potential risks and opportunities associated with investing in BTC?

Investing in BTC carries both risks and opportunities. Potential risks include price volatility, regulatory uncertainty, and security breaches. However, BTC also offers the potential for high returns and diversification benefits.