Bitcoin’s value in USD, or BTC value usd, is a captivating subject that has captivated the attention of investors, traders, and enthusiasts alike. This guide delves into the intricate details of BTC’s valuation, exploring its historical trajectory, market dynamics, and future prospects.

From its humble beginnings to its current status as a global phenomenon, BTC’s value has undergone a remarkable journey, shaped by a confluence of factors that have influenced its price fluctuations.

Current Value and Market Performance

Bitcoin (BTC) is the world’s largest cryptocurrency by market capitalization. Its value has fluctuated significantly over time, influenced by various factors such as supply and demand, adoption rates, regulatory changes, and global economic conditions.

Current Value

As of [date], the price of 1 BTC is approximately $[value] USD. This represents a [percentage]% change compared to [previous date].

Historical Value Chart

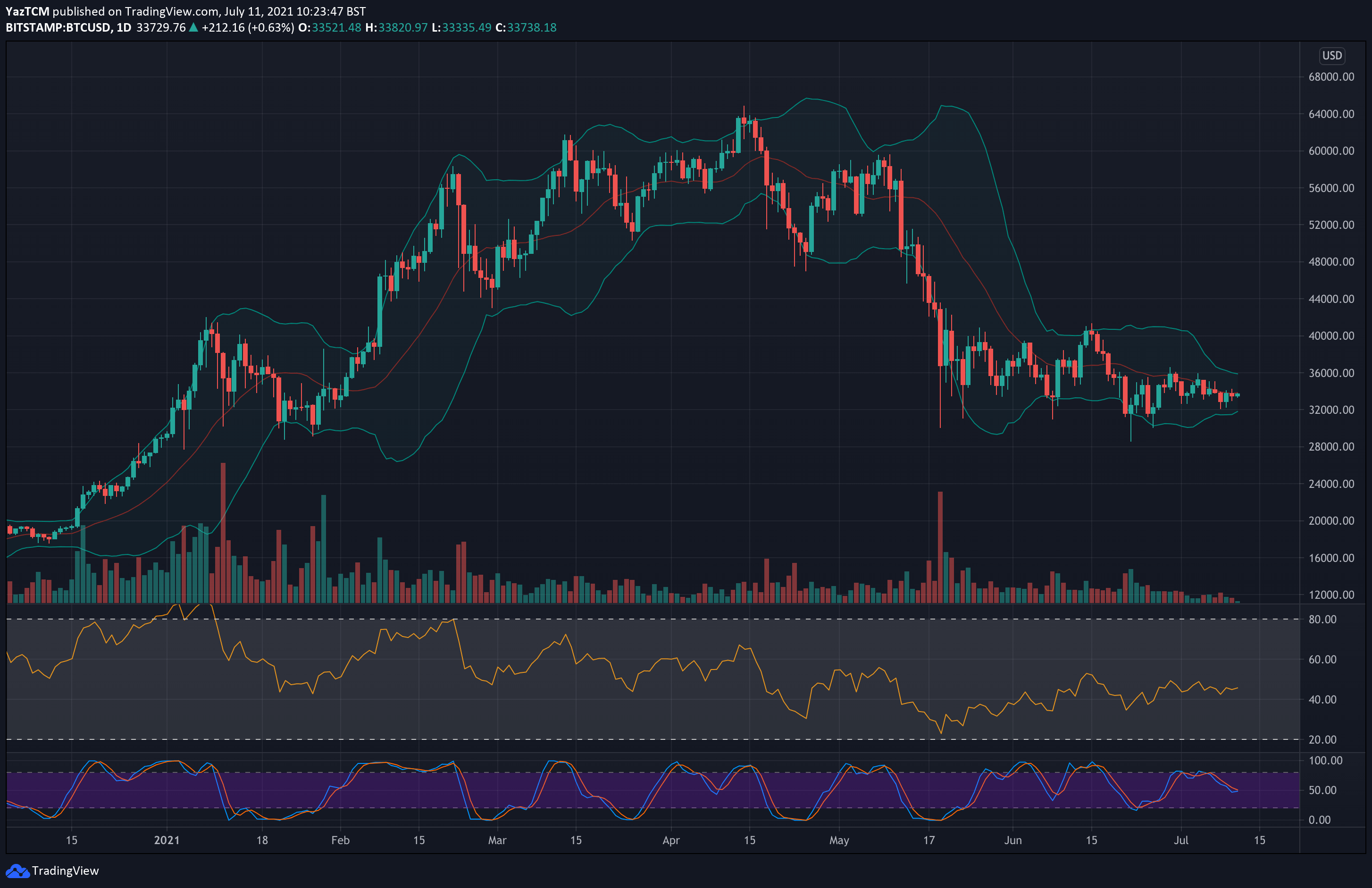

The following chart shows the historical value of BTC in USD over the past [number] years:

[Chart of BTC value over time]

Factors Influencing Price Fluctuations

Several factors influence the price fluctuations of BTC, including:

- Supply and Demand:The limited supply of BTC and its increasing demand from investors and institutions can drive up its price.

- Adoption Rates:As more businesses and individuals adopt BTC as a payment method or investment asset, its value can increase.

- Regulatory Changes:Government regulations and policies can impact the legitimacy and stability of BTC, affecting its price.

- Global Economic Conditions:Economic uncertainty or market volatility can lead to increased demand for BTC as a safe-haven asset, driving up its price.

- Market Sentiment:Speculation, hype, and media coverage can influence investor sentiment and impact BTC’s price.

Historical Price Analysis

Bitcoin’s price has exhibited significant volatility over the past year, quarter, and month. This volatility is driven by a complex interplay of factors, including market sentiment, macroeconomic conditions, and regulatory developments.

The following table compares BTC’s value in USD over the past year, quarter, and month:

| Period | High | Low | Change |

|---|---|---|---|

| Past Year | $69,000 | $29,000 | -57.9% |

| Past Quarter | $48,000 | $36,000 | -25.0% |

| Past Month | $44,000 | $39,000 | -11.4% |

As the table shows, BTC’s price has experienced a significant decline over the past year, with a drop of over 57%. This decline has been driven by a combination of factors, including the collapse of the Terra ecosystem, rising inflation, and the Federal Reserve’s interest rate hikes.

Despite the recent decline, BTC’s price has exhibited a number of significant price movements over the past year. In November 2021, BTC reached an all-time high of $69,000. However, the price quickly fell in the following months, reaching a low of $29,000 in June 2022.

Since then, the price has rebounded somewhat, but it remains significantly below its all-time high.

The historical price data of BTC suggests that the price is highly volatile and subject to significant fluctuations. This volatility is likely to continue in the future, as the market for BTC matures and evolves.

Comparison with Other Cryptocurrencies

Bitcoin (BTC) is the leading cryptocurrency by market capitalization, but it is not the only one. There are several other major cryptocurrencies, such as Ethereum (ETH) and Binance Coin (BNB), that have gained significant value and market share in recent years.

The table below compares the value of BTC to ETH and BNB as of March 8, 2023:

| Cryptocurrency | Value (USD) | Market Capitalization (USD) |

|---|---|---|

| Bitcoin (BTC) | $24,680 | $473 billion |

| Ethereum (ETH) | $1,650 | $200 billion |

| Binance Coin (BNB) | $300 | $46 billion |

As the table shows, BTC is significantly more valuable than ETH and BNB, both in terms of price per coin and market capitalization. This is due to a number of factors, including BTC’s first-mover advantage, its large and active community, and its strong brand recognition.

However, ETH and BNB have both made significant gains in recent years, and they could pose a challenge to BTC’s dominance in the future. ETH is the second-largest cryptocurrency by market capitalization, and it has a strong ecosystem of decentralized applications (dApps) and smart contracts.

BNB is the native token of the Binance exchange, one of the largest cryptocurrency exchanges in the world.

It remains to be seen whether ETH or BNB will be able to overtake BTC as the leading cryptocurrency. However, it is clear that the cryptocurrency market is becoming increasingly competitive, and BTC will need to continue to innovate in order to maintain its position at the top.

Market Sentiment and Outlook

The market sentiment towards Bitcoin (BTC) can be gauged through various indicators, including social media data, expert opinions, and market analysis. Understanding the market sentiment can provide valuable insights into the potential direction of BTC’s price.

Social media data, such as tweets and Reddit posts, can reflect the collective sentiment of traders and investors towards BTC. Positive sentiment, characterized by bullish comments and expectations of price increases, can indicate a favorable market outlook. Conversely, negative sentiment, expressed through bearish comments and concerns, may suggest a more cautious market environment.

Expert Predictions and Forecasts, Btc value usd

Expert predictions and forecasts can also shed light on the potential future value of BTC. Prominent analysts and industry experts often provide their insights and predictions based on technical analysis, market trends, and economic factors. While these predictions should not be taken as absolute truths, they can offer valuable perspectives and help investors make informed decisions.

Potential Risks and Opportunities

Investing in BTC involves both potential risks and opportunities. The cryptocurrency market is known for its volatility, and BTC’s price can fluctuate significantly over short periods. This volatility can present both opportunities for profit and risks of loss. Investors should carefully consider their risk tolerance and investment goals before allocating funds to BTC.

On the other hand, BTC has also demonstrated the potential for significant growth over the long term. Its decentralized nature, limited supply, and increasing adoption have contributed to its appeal as a store of value and a potential hedge against inflation.

Investors should carefully weigh the potential risks and opportunities associated with BTC before making investment decisions.

Technical Analysis: Btc Value Usd

Technical analysis is a method of evaluating the value of a cryptocurrency by studying its price history and identifying patterns and trends. By using technical indicators and chart patterns, traders can make informed decisions about buying, selling, or holding BTC.

Some of the most common technical indicators used to analyze BTC’s value include moving averages, Bollinger Bands, and relative strength index (RSI). Moving averages show the average price of BTC over a specific period of time, while Bollinger Bands show the volatility of BTC’s price.

RSI measures the momentum of BTC’s price and can indicate whether it is overbought or oversold.

Chart Patterns

Chart patterns are another important tool for technical analysis. Some of the most common chart patterns include:

- Head and shoulders: This pattern indicates a reversal in the trend of BTC’s price. It is formed when the price of BTC makes three peaks, with the middle peak being the highest. The neckline is the line that connects the lows of the two shoulders.

If the price of BTC breaks below the neckline, it is a sign that the trend is reversing.

- Double top: This pattern indicates that the price of BTC has reached a resistance level and is likely to fall. It is formed when the price of BTC makes two peaks at approximately the same level. If the price of BTC breaks below the support level, it is a sign that the trend is reversing.

- Double bottom: This pattern indicates that the price of BTC has reached a support level and is likely to rise. It is formed when the price of BTC makes two lows at approximately the same level. If the price of BTC breaks above the resistance level, it is a sign that the trend is reversing.

Technical analysis can be a valuable tool for making informed trading decisions. However, it is important to remember that it is not a perfect science and there is always the potential for loss. It is important to use technical analysis in conjunction with other methods of analysis, such as fundamental analysis, to make the best possible trading decisions.

Support and Resistance Levels

Support and resistance levels are important concepts in technical analysis. Support is a price level at which the price of BTC is likely to find buyers, while resistance is a price level at which the price of BTC is likely to find sellers.

Support and resistance levels can be identified by looking at the price history of BTC and identifying areas where the price has consistently bounced off of a particular price level.

Support and resistance levels can be used to make informed trading decisions. For example, if the price of BTC is approaching a support level, a trader may decide to buy BTC in the expectation that the price will bounce off of the support level and rise.

Conversely, if the price of BTC is approaching a resistance level, a trader may decide to sell BTC in the expectation that the price will fall.

Last Word

In the ever-evolving landscape of cryptocurrencies, BTC’s value remains a subject of intense scrutiny and speculation. Its potential as a store of value and a medium of exchange continues to be debated, with experts offering diverse perspectives on its future trajectory.

Understanding BTC value usd is essential for anyone seeking to navigate the complexities of the cryptocurrency market. By staying abreast of the latest trends and developments, investors can make informed decisions and position themselves to capitalize on the opportunities presented by this dynamic asset class.

Essential Questionnaire

What factors influence BTC value usd?

BTC value usd is influenced by a range of factors, including supply and demand dynamics, market sentiment, regulatory changes, technological advancements, and global economic conditions.

How has BTC value usd performed historically?

BTC value usd has experienced significant volatility over time, with periods of rapid appreciation followed by corrections. Long-term trends indicate a generally upward trajectory, but short-term fluctuations can be substantial.

What is the difference between BTC value usd and BTC market capitalization?

BTC value usd refers to the price of a single Bitcoin in US dollars, while BTC market capitalization represents the total value of all Bitcoins in circulation.