Best budget planner apps and tools are no longer a luxury; they’re a necessity in today’s complex financial landscape. Finding the right one, however, can feel overwhelming with so many options vying for your attention. This guide cuts through the noise, helping you identify the perfect budget planner to streamline your finances and achieve your financial goals.

We’ll explore key features, user experience, cost considerations, security, and integration capabilities, empowering you to make an informed decision.

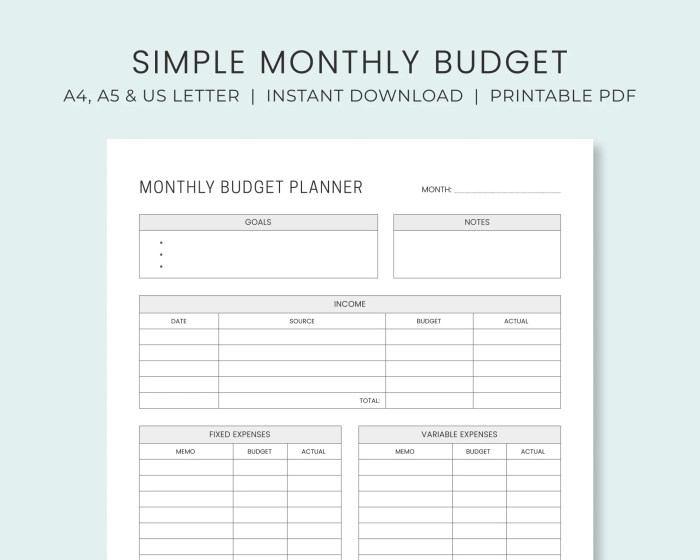

From simple spreadsheets to sophisticated apps, the world of budget planning offers a diverse range of tools catering to various needs and tech savviness. We’ll delve into the pros and cons of different approaches, helping you determine which type best aligns with your personal style and financial aspirations.

Whether you’re a seasoned saver or just starting your financial journey, this comprehensive guide provides the knowledge you need to conquer your budget and build a brighter financial future.

Integration with Other Financial Tools

Seamless integration with existing financial tools is a crucial feature differentiating a good budget planner from a great one. The ability to automatically import transaction data eliminates manual entry, a significant time saver and a major source of human error.

This integration significantly enhances the accuracy and usefulness of the budgeting process.The benefits of integrating a budget planner with bank accounts and credit cards are multifaceted. Automated data import saves considerable time and effort, allowing users to focus on analyzing their finances rather than manually inputting data.

This automation also minimizes the risk of data entry errors, leading to a more accurate representation of spending habits. Real-time updates provide an always-current view of the financial situation, facilitating proactive adjustments to the budget.

Data Import Methods and Speed

Different budget planners employ various methods for integrating with financial institutions. Some utilize screen scraping technology, while others rely on direct API connections. API connections generally offer faster, more reliable, and secure data transfer than screen scraping. The speed of data import varies considerably; some planners update transactions almost instantly, while others may take several hours or even a day.

For example, Mint, a popular budgeting app, generally provides near real-time updates via its API connections, while some lesser-known planners might rely on less efficient methods resulting in delayed updates. The frequency of updates also impacts the timeliness of the financial overview.

Security and Privacy Considerations

The security of financial data is paramount. Reputable budget planners employ robust security measures, such as encryption and two-factor authentication, to protect user information. However, it’s crucial to research a planner’s security protocols before granting access to bank accounts and credit cards.

Understanding how the planner handles data privacy is also vital. Users should review the privacy policy to ascertain how their data is used, stored, and protected. For instance, a planner might anonymize data before using it for aggregate analysis to improve its services, while others might share user data with third-party marketing firms.

This distinction is critical for users concerned about their financial privacy.

Comparison of Integration Capabilities Across Planners, Best budget planner

A comparison of several popular budget planners reveals significant differences in their integration capabilities. YNAB (You Need A Budget) offers strong integration with many financial institutions but focuses more on manual entry for finer control. Personal Capital, on the other hand, excels at aggregating data from various sources, including investment accounts, but may lack the detailed budgeting features of YNAB.

Mint provides a balance between automated import and budgeting features but its reliance on screen scraping can be less reliable than API-based integrations. This highlights the trade-offs users must consider when selecting a budget planner based on their specific needs and priorities regarding integration features.

Visual Representation of Data

Effective visual representations are crucial for transforming complex financial data into easily digestible and actionable insights. Charts and graphs provide a concise overview of budget performance, highlighting trends and areas needing attention far more effectively than raw numerical data alone.

This allows users to quickly identify potential problems and make informed decisions regarding their spending and saving habits.Visualizations enhance understanding by presenting data in a visually appealing and intuitive manner. The human brain processes visual information much faster than textual data, making charts and graphs ideal for quickly grasping financial trends and patterns.

This rapid comprehension facilitates better decision-making and promotes a more engaged approach to personal finance management.

Chart and Graph Types for Budget Planning

Different chart types are best suited for visualizing different aspects of financial data. Choosing the appropriate chart is essential for effective communication and analysis. Inappropriate chart selection can lead to misinterpretations and hinder effective budget management.

- Bar Charts:Ideal for comparing discrete categories, such as monthly income versus monthly expenses across different categories (housing, food, transportation, etc.). They clearly show the relative sizes of different budget items.

- Pie Charts:Useful for illustrating the proportion of each expense category relative to the total expenses. This provides a clear picture of where the largest portions of the budget are allocated.

- Line Charts:Excellent for tracking changes in income and expenses over time, showing trends and patterns. This allows users to monitor their financial progress and identify any significant fluctuations.

- Scatter Plots:Useful for identifying correlations between different variables, such as income and savings. This helps in understanding the relationship between various financial aspects.

Sample Monthly Income and Expense Chart

The chart would be a bar chart illustrating monthly income and expenses. The horizontal axis represents the categories of income and expenses, such as “Salary,” “Side Hustle,” “Rent,” “Groceries,” “Utilities,” “Transportation,” “Entertainment,” and “Savings.” The vertical axis represents the monetary value in dollars.

Two sets of bars would be displayed for each category: one for income and one for expenses. For example, the “Salary” category would have a tall bar representing the monthly salary income, while the “Rent” category would have a bar representing the monthly rent expense.

The chart would clearly show the difference between total income and total expenses for the month, indicating a surplus or deficit. Color-coding could be used to distinguish income from expenses, perhaps green for income and red for expenses.

The chart’s title would be “Monthly Income and Expenses[Month, Year]” and a legend would clearly identify each bar’s representation. The chart would be designed to be clear, concise, and easy to interpret, enabling users to quickly assess their financial standing for the month.

Last Recap: Best Budget Planner

Ultimately, the best budget planner is the one that best fits your individual needs and preferences. By carefully considering factors like ease of use, feature set, security, and integration capabilities, you can confidently choose a tool that empowers you to take control of your finances.

Remember, effective budgeting isn’t about restriction; it’s about mindful spending, strategic saving, and achieving your financial aspirations. Embrace the journey, and watch your financial well-being flourish.